- Manually, by adding more funds to the position, or

- Automatically, by enabling auto-mode, provided their wallet maintains sufficient balance. (in the future)

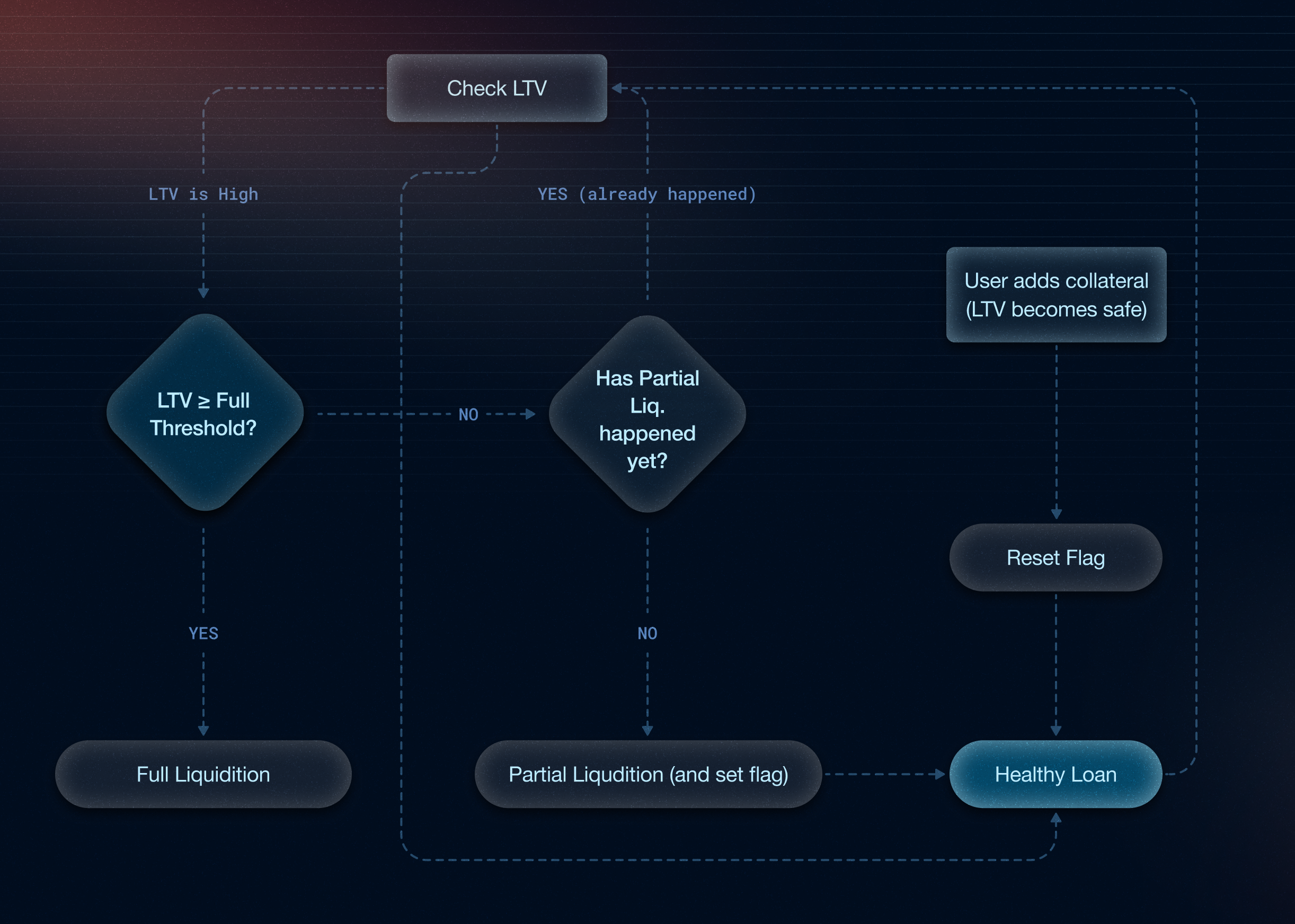

LTV (Loan-to-Value) & Liquidation Logic

LTV (Loan-to-Value) measures how much the borrower has borrowed compared to the current value of their position (LP + collateral).-

Formula:

LTV = Debt / Position Value - If the LTV gets too high (e.g., 85–90%), it means the borrower’s position is no longer safely over-collateralised and is at risk.

Partial Liquidation Logic (Individual Risk Control)

Partial liquidation is a protocol-level risk-mitigation step that sells a portion of an over-leveraged borrower’s position when their Loan-to-Value (LTV) climbs above a preset threshold, yet before a full liquidation is required. The sale proceeds are used to repay part of the borrower’s debt, pushing the LTV back into a safer range.- Partial liquidation is designed as a borrower-friendly safeguard and a way to safeguard lenders’ funds from being completely lost, offering a chance to stabilise their position before full liquidation is triggered, especially during volatile market conditions.

- Trigger: When an individual borrower’s LTV crosses the partial threshold (e.g., 85%).

- Action: A calculated portion of their LP position is closed. The resulting assets are used to repay part of the debt.

- Goal: Bring the LTV back to a safer range (e.g., down to 75%) without liquidating the entire position.

- Why: This protects lender funds while giving borrowers a fairer chance to recover compared to immediate full liquidation.

One-Time Liquidation Logic

- Partial liquidation is triggered once per liquidation cycle.

- If the borrower adds more funds and LTV drops below the safe threshold, they become eligible for partial liquidation again in the future.

- For now, partial liquidation is only applied to blue-chip and mid-cap assets

Precision-Based Recovery (Not Fixed Slice)

Unlike protocols that liquidate a fixed slice (e.g., 50%), our system calculates the exact value needed to recover 80% of the lender’s principal, based on:- The borrower’s leverage

- Current LTV

- Position size and debt

borrowed amount = debt in calculations.

Example Scenario

Let’s say:partial_threshold = 80 %full_threshold = 90 %safe_threshold = 70 %

- Borrower LTV hits 80 %

- Partial liquidation triggers, the flag is set.

- Borrower does nothing, LTV reaches 91 %

- Full liquidation triggers.

- If, after partial liquidation, the borrower adds more collateral, the LTV drops to 65 %

- System resets the flag; they get another shot.

Trigger Rules

| Condition | Action |

|---|---|

LTV ≥ partial_threshold and has_been_partially_liquidated = false | → Do partial liquidation (e.g. 50 %), then set has_been_partially_liquidated = true |

LTV ≥ full_threshold and has_been_partially_liquidated = true | → Fully liquidate the remaining position |

LTV < safe_threshold (e.g. user tops up collateral) | → Reset has_been_partially_liquidated = false |

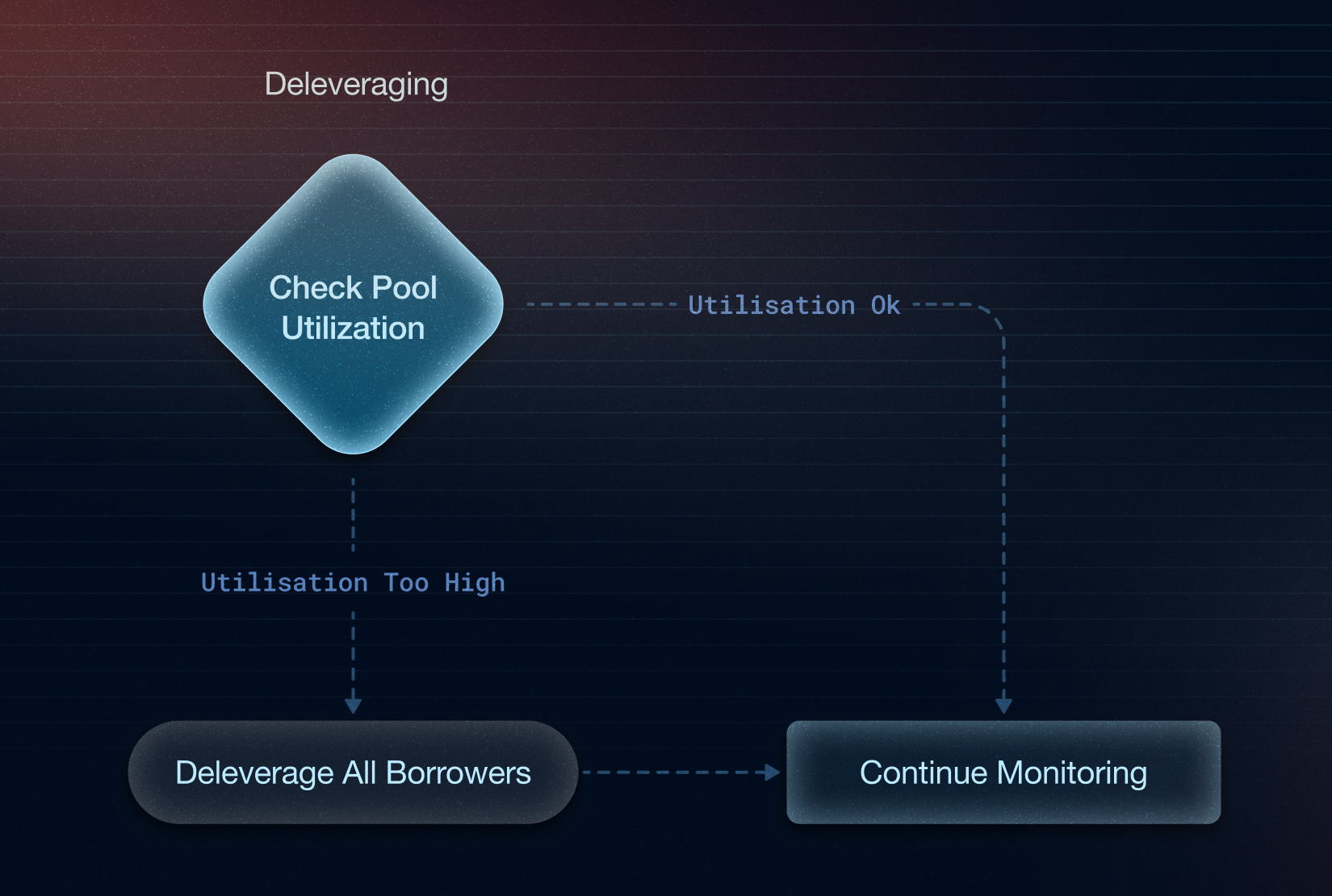

Deleveraging (System-Wide Risk Control)

- To ensure enough liquidity is available for lenders to withdraw their funds at any time.

- To reduce systemic risk in the pool by lowering the average leverage across all borrowers.

- Trigger: Utilisation of the lending pool exceeds a critical limit (e.g., 95%) and lenders may not be able to withdraw.

- Action: A portion of all borrower positions are liquidated proportionally, e.g., user 1 has 50 → both repay 10% of their debt.

Debt to liquidate

ΔB = totalBorrowed − (U_target × totalDeposits) ΔB = B − U_target · D Amount to liquidate per user For every borroweri with current debt Debtᵢ:

-

Every borrower repays the same percentage of their outstanding debt:

percentage_to_repay = ΔB / B -

After liquidation, each borrower’s new debt is

Debtᵢ_new = Debtᵢ − liquidateᵢ