User roles

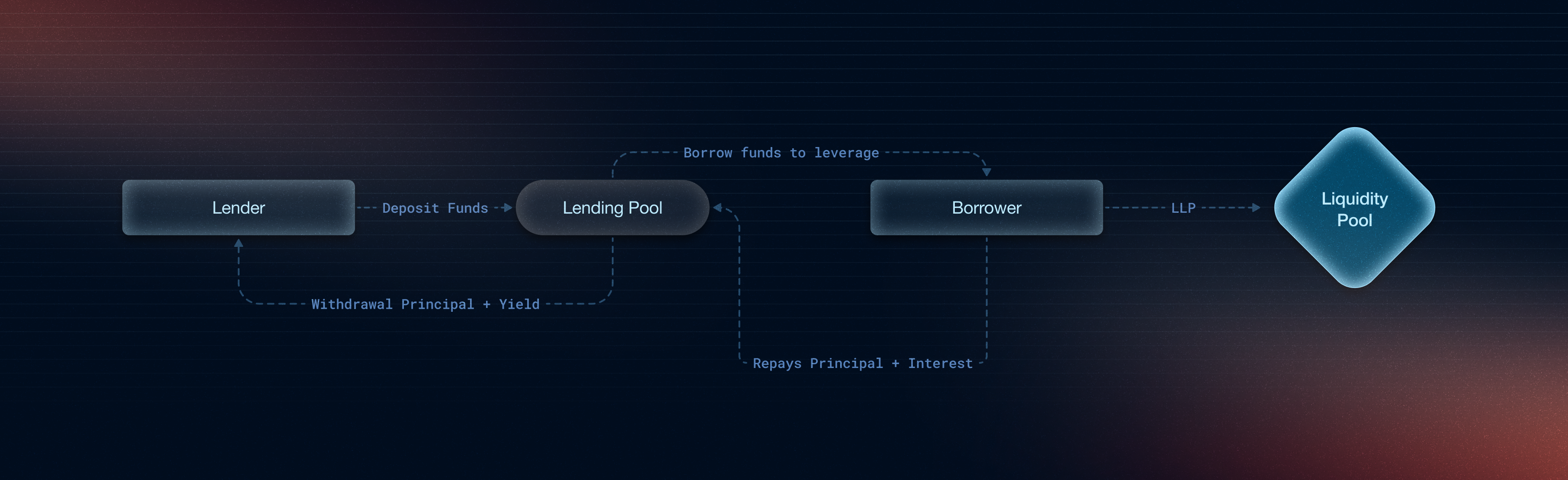

Paystream’s leveraged lending system is powered by two core user roles: Lenders and LP-users/Borrowers. Lenders supply capital to the protocol in exchange for yield, while LP-users/borrowers utilise that capital to enter leveraged liquidity positions across supported DeFi pools.1. Lenders

Lenders deposit a base asset (e.g., SOL, USDC) into the Paystream lending pool. In return, they earn interest over time based on the pool’s utilisation and borrowing demand. Their funds help power leveraged trading opportunities for other users. The protocol ensures lender capital remains liquid, allowing for instant withdrawals at any time. Interest is distributed proportionally based on each lender’s share in the pool, and accrual occurs per block.2. Leveraged LP users / Borrowers

LP users access capital from the lending pool to enter leveraged LP (Liquidity Provider) positions in supported pools like CLM (concentrated liquidity markets ), DLMM or DAMM V2. They can choose to invest manually or use auto-trading by copying another wallet’s strategy. Borrowers are required to maintain a healthy Loan-to-Value (LTV) ratio to avoid liquidation. Before entering a position, their deposited SOL is automatically converted into the appropriate tokens for the chosen pool.Pool Mechanics

Paystream tracks and distributes interest using two index systems: GLI for lenders and BLI for borrowers. Lenders earn yield based on pool utilisation. Borrowers pay interest based on their leverage tier and usage time. When repaying, the system calculates interest using the difference between the current and initial index values. This setup keeps the yield distribution accurate and efficient without constant updates.1. Global Liquidity Index (GLI)

GLI refers to the cumulative index values used to track interest accrued by borrowers and earned by lenders over time. It represents how the lending pool grows and how borrower debt compounds, serving as the core mechanism for calculating interest and yield in the protocol.- Maintained for both lenders and borrowers

- Increases with each borrower-interest event

- Used to calculate lender yield on exit

- For lenders: store

LLI_entryat the time of deposit - For borrowers: store

BLI_entrybased on their leverage tier

Note: Because there are three borrowing-rate tiers (by leverage), we maintain three global indices on the borrowing side.

a. Lending liquidity Index

LLI represents how much the lending pool has grown over time due to interest paid by borrowers. When a lender deposits funds, a snapshot (LLI_entry) is taken. When the lender exits, the current index (LLI_now) determines how much yield they’ve earned. LLI update formulab. Borrower liquidity index

The Borrower Liquidity Index (BLI) is a running “interest meter” that tells us how much a borrower’s debt has grown since they opened the position.- When a loan is taken, we snapshot the index as BLI_entry.

- As blocks pass, the index rises with the applicable borrow rate.

- At repayment, the ratio BLI_now / BLI_entry shows the exact interest multiplier to apply to the original principal.

- There are three separate Borrower Liquidity Indexes because each leverage tier (1×, 2×, 3×) has a different interest rate. To track interest accurately for each borrower type, a dedicated index is maintained per tier, ensuring precise repayment calculations.

| Tier | Typical LTV / leverage | Symbol |

|---|---|---|

| 1 | ≤ 1 × (safe) | BLI₁ |

| 2 | ≤ 2 × (medium) | BLI₂ |

| 3 | ≤ 3 × (high) | BLI₃ |

Note 1 + rate × Δt is the compound-interest factor.

For simple interest, replace it with borrowRate × Δt.

Note - for each category, a different index is calculated

2. Interest rates

a. Borrow-Rate

The borrowing rate reflects the cumulative interest paid by borrowers on their borrowed principal. It increases over time based on utilisation and risk tier, and directly impacts how much debt a borrower owes at the time of repayment.- Borrow rate depends on

- Types of pools and leverage levels (maximum of the category)

- 12 % for 1 – 1.5 × leverage

- 15 % for 1.5– 2× leverage

- 17 % for 2 – 3× leverage

- utilisation rate The borrowing rate is variable at every utilisation point.

- Types of pools and leverage levels (maximum of the category)

B_t= Current borrow interest rateB_F= Borrow rate at the floor-utilization knot pointB_C= Borrow rate at the ceiling-utilization knot pointU_t= Current utilization rateU_F= Floor utilization knotU_C= Ceiling utilization knot

Note:total borrow rate

These parameters are carefully chosen to dynamically adjust borrow rates based on utilisation.

This helps reduce systemic risks, prevent liquidity crunches, and ensure fair interest pricing.

B1,B2,B3= Borrow rates for leverage levels different categoryU1,U2,U3= Utilisation (borrowed amount / total available) for each borrower typetotalUtilization = U1 + U2 + U3