Liquidation Mechanism in Paystream

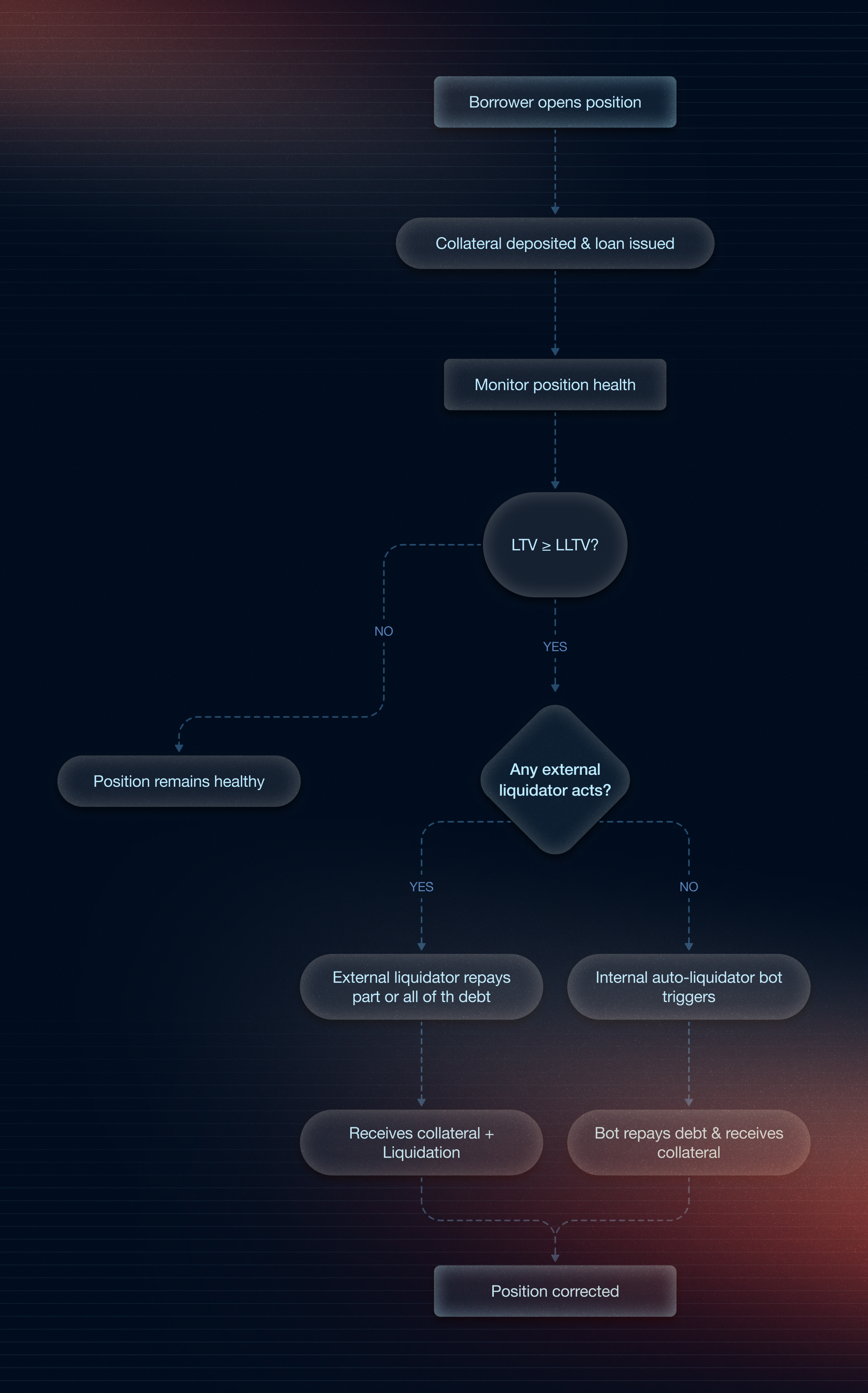

Liquidation is a critical component of Paystream’s risk management system. It ensures that lender funds remain secure, even in volatile market conditions. When a borrower’s position becomes undercollateralized, liquidation is triggered to prevent the protocol from incurring bad debt. Paystream employs a liquidation mechanism, triggered when a borrower’s Loan-To-Value (LTV) ratio exceeds a predefined threshold known as the Liquidation LTV (LLTV). This system is designed to be both reliable and efficient. To enhance this process, Paystream also operates an in-house automated liquidator bot. This bot continuously monitors the protocol and acts alongside external liquidators to ensure timely and consistent liquidation execution, especially in cases where external participation may be delayed or insufficient.Understanding LTV (Loan-To-Value)

LTV represents the ratio of borrowed funds to the value of the collateral. It’s the primary metric used to assess the health of a borrowing position. LTV Formula:- Borrowed Amount is the total debt held by the borrower (in base units of the loan token).

- Collateral Value in Loan Token is calculated as:

Health Factor

The Health Factor is a normalised measure of a position’s risk. A value greater than 1.0 indicates a safe position, while values below 1.0 mark it as liquidatable. Health Factor Formula:- LLTV is the market-defined liquidation threshold (e.g., 0.86 for 86%)

Liquidation

The liquidation system ensures that Paystream remains solvent by allowing unhealthy positions to be corrected swiftly.When Does Liquidation Occur?

A borrower’s position becomes eligible for liquidation when their LTV exceeds the LLTV. This can happen due to:- A drop in collateral value

- An increase in debt (e.g., from accrued interest)

- Both of the above

- The position is safe as long as the borrowed value ≤ $86

- It becomes liquidatable when borrowed value > $86